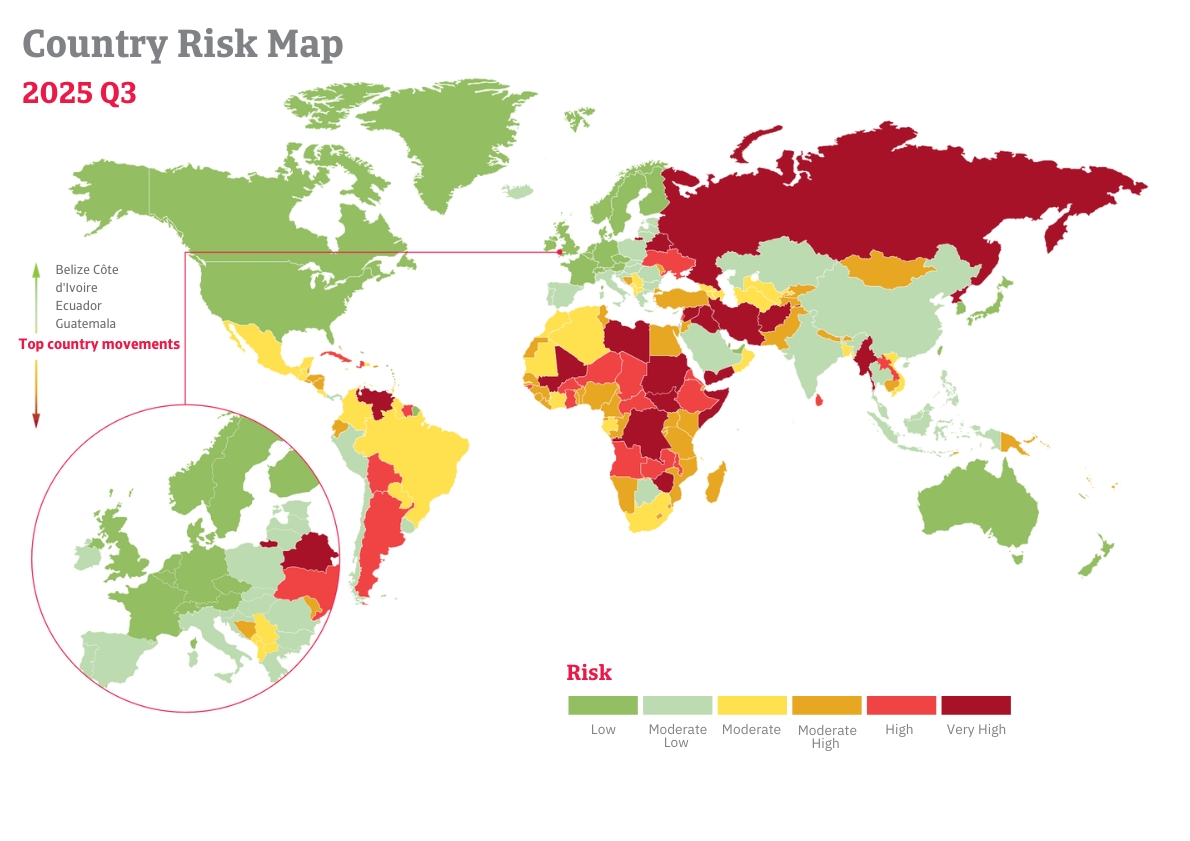

The latest Country Risk Map update provides an overview of risk levels across more than 200 countries and territories. Of these, 76 fall into the low-risk categories, and 27 into moderate risk. The largest segment comprises 104 countries rated at high-risk levels. This assessment serves as a reminder that risk remains widespread and helps businesses stay aware, understand, and manage the challenges of international trade.

In the face of persistent global uncertainty, country risk dynamics have actually improved in Q3. Ecuador, Guatemala, and Côte d'Ivoire stand out for their evolving economic and political dynamics.

In the face of persistent global uncertainty, country risk dynamics have actually improved in Q3. Ecuador, Guatemala, and Côte d'Ivoire stand out for their evolving economic and political dynamics.

Côte d’Ivoire has strengthened its position within the moderate risk category, supported by solid economic growth, a declining fiscal deficit and public debt, and continued access to international capital markets alongside IMF backing.

Guatemala continues to demonstrate resilience, with prudent policymaking and steady GDP growth helping to offset traditional governability challenges. External buffers have strengthened, reducing vulnerability to shifts in US policy.

Ecuador benefits from debt restructuring, fiscal consolidation and policy adjustments under IMF support. Improved government finances, stronger external liquidity and greater policy continuity following recent elections underpin this positive outlook.

What is the Atradius Risk Map?

The Atradius Risk Map provides a global view of country risk levels, based on data compiled by our Economic Research Team. Using the STAR rating system, it assesses political and economic risks, civil unrest, and conflict to help businesses navigate uncertainty.

Our interactive Risk Map allows you to explore risk levels by country. Each profile includes key macroeconomic indicators, the STAR rating, ESG ranking, and expert insights on industry performance.

For companies engaged in international trade, a stable business environment is essential. Adverse developments can impact profits and investments. Monitoring both the level and changes in country risk is critical, but it’s only part of the picture. Ultimately, payment responsibility lies with end customers, making their financial stability and reliability crucial for successful transactions.

Credit insurance supports this process by analysing potential clients before relationships begin and continuously monitoring risks. To learn how these insights can strengthen your credit risk strategy, get in touch with us and discover how we can help you stay ahead.

- The latest Risk Map assesses risk levels across more than 200 countries and territories. With 104 countries rated at high risk levels, continuous monitoring is essential to navigate global trade challenges effectively

- Recent developments in markets such as Ecuador, Guatemala and Côte d’Ivoire illustrate how economic and political dynamics can shift quickly. Staying informed is key to managing exposure and making sound decisions in international trade