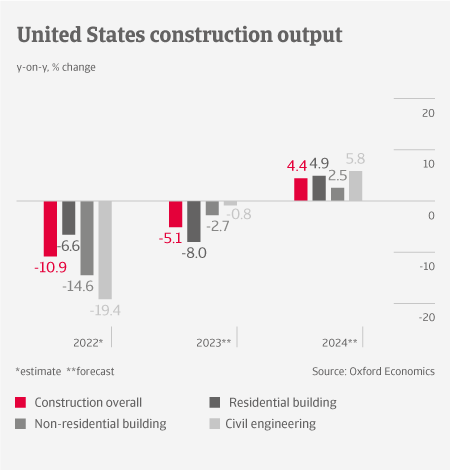

US construction output is forecast to contract by 5% in 2023, mainly due to a slump in residential construction. Rising interest rates lead to higher costs of project financing, while inflation has increased construction material costs. Supply of skilled workers and supply chain disruptions have led to longer lead times with project delays. The lack of skilled labour and an ageing workforce could curtail potential construction output in the future.

We expect the residential building segment to see the largest contraction, because aggressive monetary tightening is feeding into higher mortgage rate, and high inflation weighs on the affordability of homeownership. However, non-residential construction remains more resilient due to government stimulus. The Infrastructure Investment and Jobs Act will provide stimulus for construction this year, aiming at comprehensive investments in ageing infrastructure (including roads, highways, bridges, rail, and broadband development). Additionally, the Inflation Reduction Act encourages spending on energy-efficient and sustainable building activities.

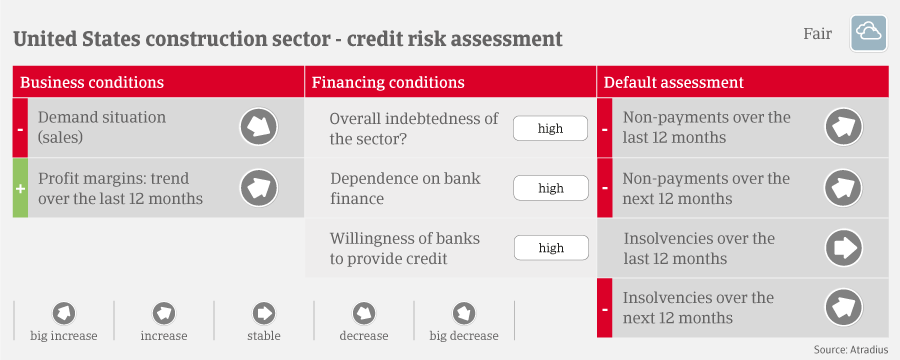

During the past twelve months profit margins of businesses have improved because businesses have been able to pass along higher input costs to their customers. However, we expect that construction companies will need to work through bloated inventory levels and deal with higher operating and financing costs, which should diminish margins going forward. Higher working capital requirements brought on by supply chain issues have caused cash flows to turn negative in some parts of the industry.

Payments in the construction industry take about 60 days on average. Given the length of projects, protracted payments are fairly common in the industry, with payments made as the stages of projects are achieved.

Due to the economic slowdown, subdued demand in residential construction and rising pressure on margins we expect both payment delays and insolvencies to increase in 2023. With high interest rates and a slowdown in activity, businesses with limited liquidity and/or elevated debt levels will face difficulties in servicing their obligations.

Given the more subdued credit management situation and business performance of the construction industry, we have recently downgraded our sector outlook from “Good” to “Fair”.