Due to a high level of non-performing assets in the sector banks are now unwilling to provide credit to the industry, causing additional liquidity issues.

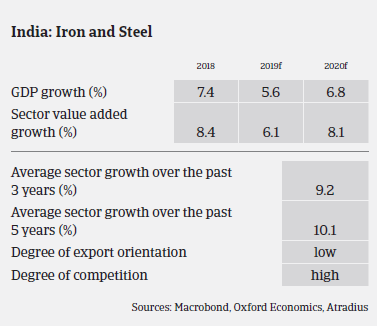

India’s steel pruduction increased 3.3% year-on-year in the 2019 financial year (April 2018-March 2019) and 1.3% between April and September 2019. Domestic steel prices have decreased 13% since January 2019, due to a low global price level and weak domestic construction and infrastructure activity. At the same time, production and sales in the Indian automotive sector, another major buyer industry, has been subdued.

Profit margins have decreased since H2 of 2018, and are expected to deteriorate further in 2020. While a robust rebound of demand is not expected in the short-term, there is significant potential for long-term growth, given the low per capita steel consumption in India. However, the effective implementation of government policy reforms remains to be seen. Officially the government plans to triple India’s annual steel production capacity to 300 million tonnes by 2030, giving preference to locally manufactured steel, whilst reducing imports to zero.

Competition remains fierce, especially from global players. Demand for imports remains high despite various measures taken by the Indian government to shield domestic businesses from foreign competition.

Payments in the Indian metals and steel industry take between 60 and 90 days on average. Payment delays are common.

Many Indian metals and steel businesses are highly leveraged and heavily depend on bank financing for their working capital requirements. However, due to a high level of non-performing assets in the sector, with some larger companies defaulting and struggling to repay debt, banks are now unwilling to provide credit to the industry. This is causing additional liquidity issues for many businesses.

Five steel companies, which account for a fifth of India's crude steel capacity, have already filed for insolvency proceedings and are in a resolution process. Stronger companies have taken over those stressed assets in order to enlarge their domestic market share. Due to the ongoing consolidation in the market, with larger players acquiring smaller and troubled businesses, a further increase in insolvencies is not expected in the short-term.

Our current underwriting strategy for metals and steel continues to be restrictive. We remain cautious with trading firms and non-incorporated entities, segments where we have witnessed several credit insurance claims in the past. We insist on reviewing companies with their latest audited financials, also taking into account customer profiles and credit management capabilities.

Related documents

1.06MB PDF