Large backlog of medical treatments to sustain growth in the coming years

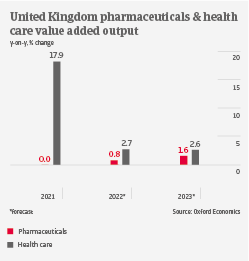

Pharmaceuticals value added output in the UK levelled off in 2021 after a strong 13.6% increase in 2020, which still leaves it 13% above the 2019 pre-pandemic level. The vaccination rollout and demand for pandemic-related drugs (e.g. medications to treat fever, drugs for intensive care) has driven growth, resulting in high profit margin increases for producers, and to a lesser extent for wholesalers and pharmacies. However, for some businesses border checks and regulatory burdens, due to Brexit, have raised costs and has delayed delivery of goods. Some businesses moved their operations to other European countries in order to retain easier market access in the EU.

There is still a large backlog of non-Covid related medical and elective care hospital treatments. The government and the NHS recently announced they would address this with a major catch-up programme over the next three years. This should sustain ongoing demand for pharmaceuticals.

Another growth driver in the mid- and long-term will be ageing of population. This will in particular spur demand for speciality drugs related to chronic diseases. However, despite higher public healthcare spending in the short-term, cost constraints will remain an issue in the long-term, and there will be pressure by the government and public health authorities on pharmaceutical businesses to lower sales costs of drugs. Rising imports of cheaper generics could be an outcome of cost pressures in the health system.

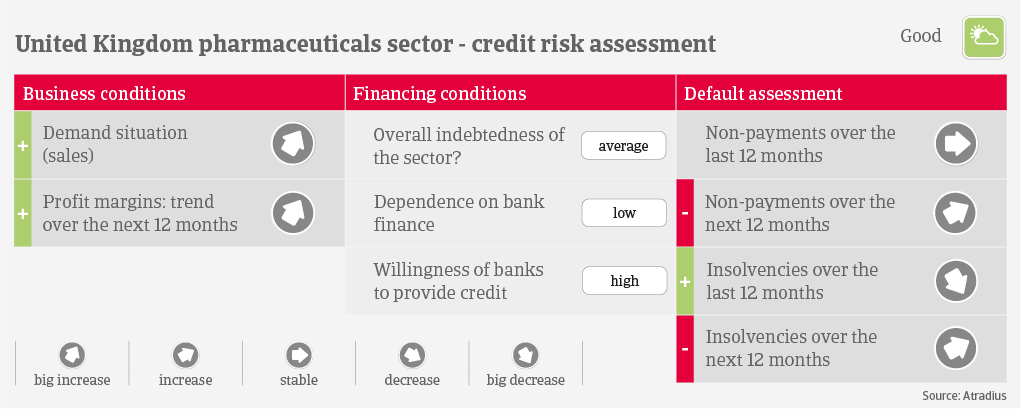

Payments in the industry take about 60 days on average, but longer payment terms imposed by the NHS are common. Payment behaviour has been very good over the past two years, and the number of both payment delays and insolvencies has been extraordinarily low in 2021.

With the expiry of large pandemic-related government support measures both payment delays and insolvencies could increase slightly year-on-year in 2022. However, this would only mean a reversion to the already low and stable levels seen in the years prior to the pandemic. Due to low credit risk, the robust demand situation and the financial strength of most businesses, our underwriting stance remains open across all segments.

Related documents

969.0KB PDF