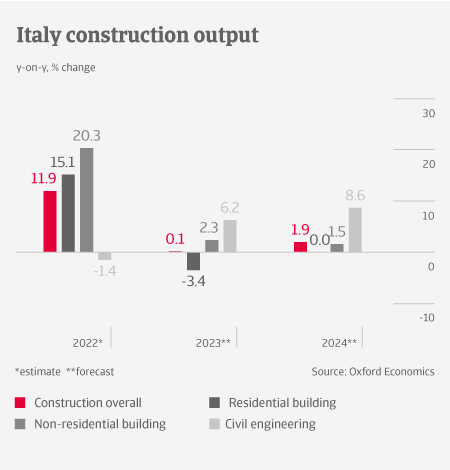

After a whopping 12% growth in 2022, Italian construction output is forecast to stagnate in 2023. This is mainly due to a contraction in the residential building segment, triggered by high inflation and deteriorated household purchasing power. A “superbonus” government scheme drove energy-saving home improvements in 2022 (it provided homeowners with a tax deduction of 110%, allowing them to renovate at no cost). However, since the beginning of 2023 the tax reduction was reduced to 90%, and due to the surge in energetic renovation, prices for solar plants, boilers and window frames have sharply increased.

Civil engineering activity in 2023 and beyond is driven by investments in infrastructure, energy security and power grids funded by the EU´s Recovery and Resilience Facility (RRF). While there have been project delays in 2022, it is expected the rollout will gain momentum this year.

The high price increases for energy and raw materials have a major negative impact on the profit margins of construction companies. While the government has provided support in 2022 to dampen those effects, applications are overly complex, with the result that about 70% of companies have not been able yet to cash in the funds. Some measures to adjust the cost of works to market prices leave out the private sector and only affect public works.

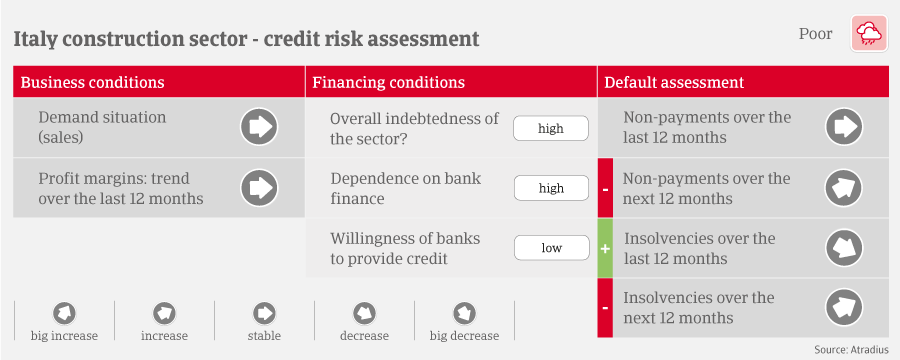

Payments in the Italian construction industry take 200- 250 days on average. SMEs in particular suffer from the bad payment behaviour of public bodies. We expect that both payment delays and insolvencies will increase in 2023, with businesses dependent on the residential construction segment most affected. Business failures could increase at double-digit levels, although from low levels seen in 2021 and 2022.

Structural weaknesses continue to affect the credit risk outlook of the sector. These include tight margins and high gearing of businesses, combined with tight lending conditions. Banks are generally unwilling to provide loans to construction businesses due to a history of high levels of default. The willingness of banks to grant loans to construction companies has steadily decreased, from EUR 52 billion in 2007 to EUR 15 billion in 2022.