Ongoing pressure on cash flow amid anxiety over bad debts

Although conditions in Japan’s B2B credit risk environment appear stable on the surface, our survey finds there are some signs of vulnerability affecting businesses

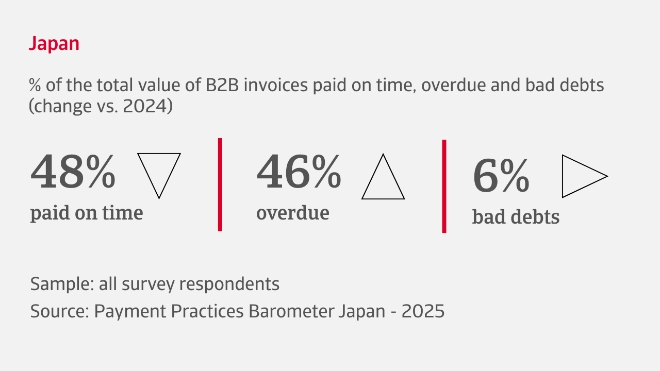

53% of companies tell us that customer payment behaviour has remained consistent in recent months, while overdue invoices currently affect 45% of B2B sales on credit. On average, overdue payments are settled more than a month past due, with the prime causes being customer liquidity issues and delays in the payment process.

Bad debts have levelled off at an average 6% of B2B invoices, reflecting ongoing pressure on cash flow for many businesses across all sectors. Against this backdrop, nearly half of companies in Japan have not increased trade credit offerings in recent months, aiming to avoid increased exposure to customer payment risk. Most firms have kept payment terms unchanged, with average credit periods standing at 45 days from invoicing.

What are the concerns for Japanese businesses in the coming months?

Cautious mood amid widespread concern about sales and profitability

A wait-and see stance is taking hold among Japanese companies as they look to the second half of the year and beyond. While 58% of firms in our survey expect the level of B2B customer insolvencies to remain unchanged, this perceived stability is undercut by growing concerns about domestic economic conditions and ongoing uncertainties in global trade policy. These macro-economic pressures are weighing on business confidence and shaping financial expectations across industries.

Most companies anticipate little to no change in key working capital indicators in the months ahead. Payment collection cycles (DSO), inventory turnover, and supplier payment timings (DPO) are all expected to remain stable. While this consistency ensures predictability, it also implies limited flexibility to accelerate cash flow generation from receivables or stock. In such an uncertain economic environment, this could create liquidity pressure, particularly if suppliers shorten payment terms to safeguard their own liquidity levels.

Companies in Japan are expressing growing concerns about customers not paying on time. With the economy so unpredictable, many are playing it safe to protect themselves from financial risks

Industry insights

Chemicals

44% of B2B sales in the chemicals sector are transacted on credit, reflecting a cautious but steady approach to trade credit. While a smaller share of companies has increased credit offerings, the majority maintain a preference for upfront payments. Payment policies are largely unchanged, average terms set at 44 days from invoicing., while late payments currently affect 48% of B2B transactions. On average, these are settled more than a month past due, mostly due to inefficiencies in customer payment processes. While bad debts remain aligned with overall averages, at nearly 6%, this still places strain on cash flow.

Consumer durables

The consumer durables sector transacts 51% of B2B sales on credit, a sign of steady trade credit practices. While most companies have consistent credit policies, a notable share are expanding credit offerings to support buyers amid evolving market conditions. Invoice payment terms average 42 days, while overdue payments now affect 49% of all B2B invoices. Delays are largely driven by invoice disputes and inefficiencies in customer payment processes, and mean that overdue payments typically extend more than a month beyond due dates. Bad debts currently average 8% of B2B invoices, putting pressure on cash flow and increasing financial exposure.

Textile and clothing

A risk-averse shift in B2B trade credit policy is evident in the textile and clothing sector with just 44% of B2B sales transacted on credit in recent months. While most companies have an unchanged approach to offering credit, a notable number have reduced credit availability to limit exposure to customer payment risk. Payment terms are steady, averaging nearly 50 days from invoicing. Overdue payments currently affect 40% of B2B invoices, the primary causes being delays in customer payment processes and ongoing liquidity issues, creating a drag on cash flow. Bad debts average 5% of B2B invoices, representing a concern for financial stability.

Interested in finding out more?

For a complete overview of the 2025 survey results for Japan, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- Overdue invoices affect 45% of B2B credit sales, with payments usually delayed by more than a month, mainly caused by customer liquidity challenges

- Over half of Japanese companies continue to pay their suppliers on time, but among those changing their payment practices, slower payments are common

- Japanese companies are taking a wait-and-see approach, with 58% expecting insolvencies to stay steady, but economic and trade concerns are lowering business confidence

- As Japan’s corporate sector braces for economic and trade-related headwinds through the year ahead, many express growing concerns about financial vulnerabilities