Stable credit risk situation for the time being, but downside risks remain

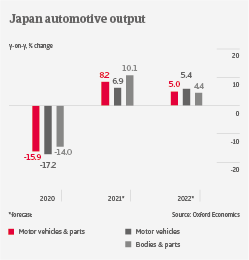

After contracting 15.9% in 2020, Japanese automotive output is forecast to rebound by about 8% in 2021 and 5% 2022. After a 17.2% decrease last year, new car sales are expected to recover by only 4% in 2021, affected by lower supply due to semiconductor shortages, and a resurgence of coronavirus cases in Japan. In 2022, domestic car sales are forecast to grow 7%.

The current shortage of semiconductors has led to lower output by large Original Equipment Manufacturers (OEMs) since August. Japanese OEMs are additionally affected by the closure of car part plants in Southeast Asia due to a recent surge of coronavirus cases in the region. Higher costs for semiconductors have led to decreasing margins of Japanese small- and medium-sizes suppliers.

Regarding e-mobility, the government has raised subsidies for electric vehicles (EV), and aims to increase the number of EV charging stations to 150,000 by 2030. The major OEMs support e-Mobility Power, a joint venture established to construct, maintain and operate charging stations and related electrical infrastructure. Joint ventures and mergers among smaller suppliers are expected to increase in the coming years, in order to overcome technological shortcomings, and to raise more funding for R&D investment.

Japanese automotive businesses are not overly indebted, and there is still room for refinancing, as banks are generally willing to provide loans. Payments in the automotive industry take about 30 - 60 days on average. There was no notable increase in protracted payments in 2020 and in H1 of 2021, and no change is expected, as the rebound should gain momentum next year. Insolvencies are forecast to level off in the coming twelve months. However, there is still the downside risk of a prolonged semiconductor shortage in 2022, coupled with persistently high raw material prices. This could additionally strain the already thin margins of smaller suppliers. It could also trigger a longer credit cycle, leading to a deterioration of payment behaviour, and more business failures among Tier 1 & 2 businesses.