A more difficult year ahead

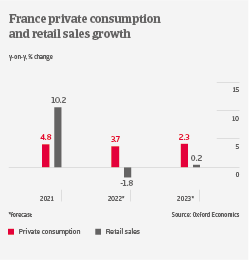

The French consumer durables market recorded robust growth in 2021, driven by remote working, household investments in home furnishing and a trend towards premium goods purchase. Sales of large household appliances sales increased 11%, while those of smaller items rose 3%. After a 5% decline in 2020 due to lockdowns, furniture sales increased by 14% last year. Consumer electronics grew just 2% in 2021, affected by the global shortage of electric components. Online sales accounted for 31% of household equipment sales, and retailers continue to rollout omni-channel sales strategies.

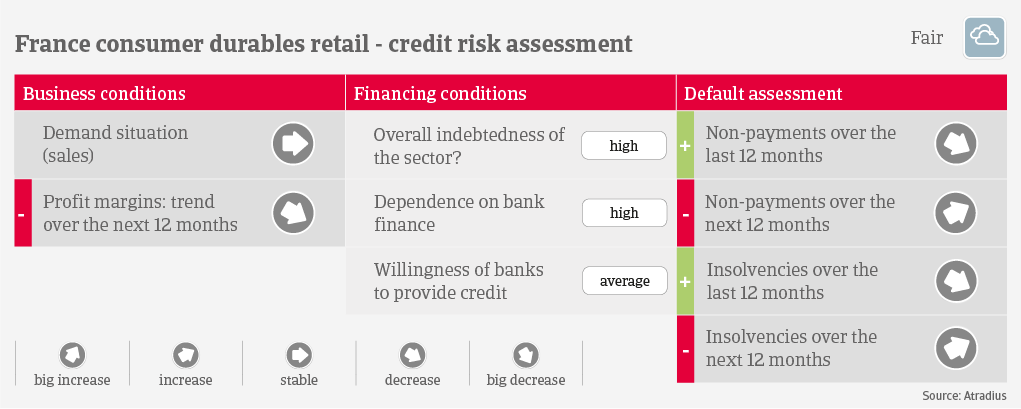

2022 will be a more difficult year for the industry. Higher raw material prices and transport costs have increased input prices, while at the same time rising prices for energy, fuel and food affect household purchasing power. Pre-election concerns weighed on household expenses in early 2021. We forecast retail sales in France to contract by about 2% in 2022 after a 10% increase last year, and (already thin) profit margins of consumer durables retailers should decrease in the coming months. Many businesses try to pass on higher production and transports costs to end-customers, but this could be difficult due to the fierce competition in the market and less room for discretionary spending. In order to preserve margins, the product mix is key (e.g., margins are usually higher in the household appliances segment).

External financing requirements and gearing of consumer durables retailers are high, due to high working capital requirement and peak sales periods. Payments take 45 days on average, and the number of non-payments has been low in 2021. Insolvencies decreased in 2021 by about 30%, due to favorable market conditions and Covid-related fiscal measures (e.g. state-guaranteed loans). With the phasing out of those measures, we expect that both payment delays and insolvencies in the retail sector will increase as of H2 of 2022.

However, we do not expect a significant deterioration of the insolvency situation, rather a return to “normal” levels seen prior to the pandemic in 2019. Given the slowdown of revenues and higher credit risk, our underwriting stance is neutral for all consumer durables main subsectors.