Mid-sized businesses are facing profitability issues due to higher labour costs triggered by shortage of qualified staff and increased commodity prices.

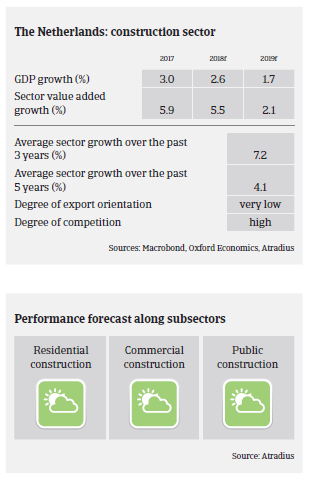

- The construction industry continued to grow in 2018, in line with the overall Dutch economic performance. Construction gross added value increased more than 5% year-on-year. In Q3 of 2018 civil and utility construction sales increased more than 11%, while infrastructure related sales rose more than 6%.

- At year end 2018 about 174,000 construction companies were registered in the Netherlands, of which 148,000 are one-man businesses, while 26,000 employ between 2 and 250 people. Only 55 companies are larger, employing more than 250 people. While competition in the Dutch construction market is high, there are currently no price wars.

- After an increase in 2017 profit margins of construction businesses decreased in 2018, mainly due to higher labour and material costs. Especially mid-sized and larger construction businesses had trouble in passing on increased expenses for salaries and materials/commodities to end-customers, due to fixed price agreements. According to CBS, profitability decreased 10% in Q4 of 2018 in the building industry. In order to sustain and to increase profit margins businesses try to improve working and earning practices (e.g. stricter tender procedures and more standardised residential building).

- Payment duration in the industry is 60-90 days on average. After a steep increase during the post 2009 crisis years, a decrease in non-payments and insolvencies was recorded between 2015 and 2017. That said, there was a slight increase in non-payment notifications and insolvencies over the past six months, and business failures are expected to increase further in H1 2019, albeit modestly. mid-sized construction businesses facing ongoing profitability issues due to elevated labour costs (shortage of qualified staff) and increased commodity prices could be the most affected.

- Growth prospects for 2019 remain generally benign, with residential construction expected to grow 5%. Infrastructure-related construction is expected to benefit from more government projects over the next couple of years. Therefore, our underwriting stance remains relaxed for all major subsectors (residential construction, commercial construction and public construction) as well as for construction materials.

- However, short-term growth prospects remain below potential, hampered by a backlog in approved building permits, as public building authorities currently lack staff and resources to cope with the increased number of requests for permit procedures. This could potentially cause capacity issues for some Dutch construction businesses.

- When assessing a buyer’s creditworthiness, we require up-to-date financial information, and details of their 2018 order book and payment experience. Additionally, we seek details on a company’s financing (covenants/securities), the maturity dates of bank loans and we scrutinise work-in-progress and working capital positions.

相關資料

1.19MB PDF