Due to limited organic growth opportunities and the on-going economic uncertainty, market players strive to expand through acquisitions and specialisation.

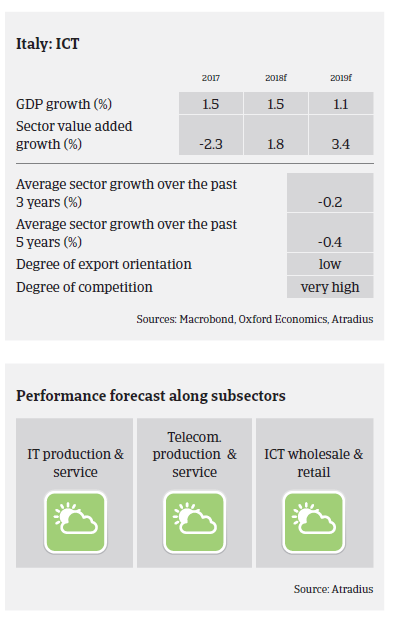

- According to the industry association Assinform, the Italian ICT market grew 1.9% in 2017, to EUR 66.1 billion, and in 2018 another 1.8% increase is expected. Main growth segments are IT services, hardware and e-commerce (the latter expected to increase 26% in 2018 to EUR 29 billion, from EUR 23 billion in 2017).

- In the business-to-business segment larger companies still account for more than 60% of total domestic IT expenses, while demand from the public sector and the IT spending capacity of SMEs remains modest.

- In most ICT segments margins remained stable in 2017. Due to rather modest organic growth opportunities and market adjustment in the distribution segment, players strive to expand through acquisitions and specialisation (customised and value-added services).

- Both financial gearing and dependence on bank loans are high in the Italian ICT sector. Payments in the industry generally take around 120 days, payment experience has been good so far and the level of notified non-payments is low. The amount of ICT business failures is rather low compared to other Italian industries, and expected to remain stable in 2018.

- Our underwriting approach remains generally open for all ICT segments, due to the benign credit risk situation, the general need of Italian businesses to increase IT spending in order to boost productivity, and increasing demand for innovation through digitalisation, cybersecurity, Big Data, electronic payments, cloud computing.

- However, as in 2017, low value added wholesalers and smaller players have to be monitored more closely, as they are more exposed to financial distress related to working capital requirements, especially when depending on large clients and the public sector. We also maintain a more cautious approach on wholesalers with low value added services and poor critical mass and any businesses which are higly dependent on sales and services to the public sector (due to common late payments by public bodies).

相關資料

1.04MB PDF