All survey respondents in Austria (100%) reported domestic payment delays. This is the highest percentage in the region, significantly higher than in 2017.

Based on the survey results, 2018 brought many changes in Austria – more frequent payment delays, an increase in the proportion of overdue B2B invoices, a longer invoice to cash turnaround and a higher proportion of uncollectables. A notable percentage of respondents reported that their businesses have been impacted by late payment. To manage the impact, they had to pursue additional financing, correct cash flow, or postpone their own payments to suppliers. 18.9% of respondents reported that past due B2B invoices led to revenue loss.

Regular customers more likely to be offered credit

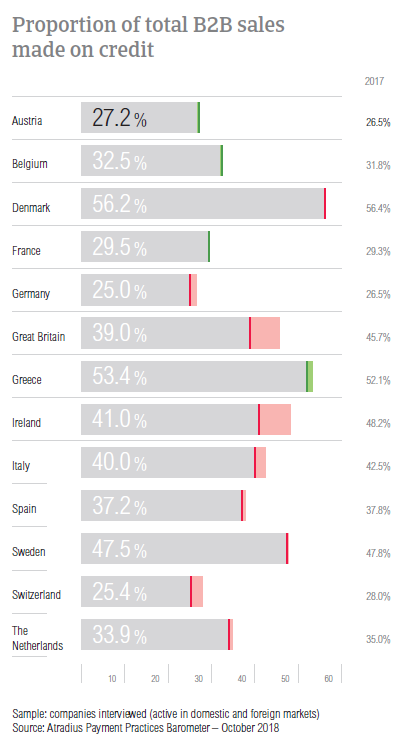

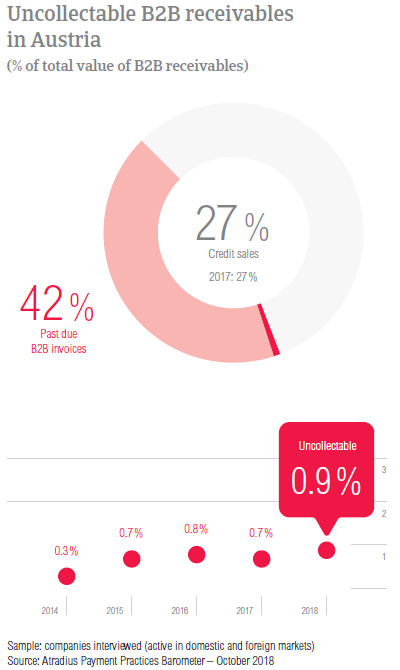

The proportion of total B2B sales made on credit in Austria is stable at 27.2% (26.5% in 2017). Like most of their peers in the region, Austrian respondents used credit in a higher proportion of sales to domestic B2B customers (on average, 32.1%) than to B2B customers abroad (22.3%).

Most respondents offer credit to domestic B2B customers because they are familiar with domestic business practices and for the loyalty of return customers. Austrian respondents also mentioned their wish to develop further locally. When confronted with poor payment behaviour and with financially weak customers, respondents in Austria do not grant trade credit to their domestic B2B customers (mentioned by 40.5% and 21.4% of respondents).

We trade on credit with regular customers, with whom we have built long-term partnerships and whom we trust. New customers are granted trade credit only if we believe that the business relationship will last longer.

Companies in Austria grant trade credit to their foreign B2B customers for the same reasons: regular customers whom they trust and because credit sales are common practice in the sectors they operate in. The top reasons for refusing to grant trade credit to foreign B2B customers are: a lack of information on the customer’s business and payment performance (mentioned by 32.5% of respondents) and high economic and political risk in the customer’s country (mentioned by 35.0%).

We trade on credit with foreign B2B customers because it is a common trend in the market.

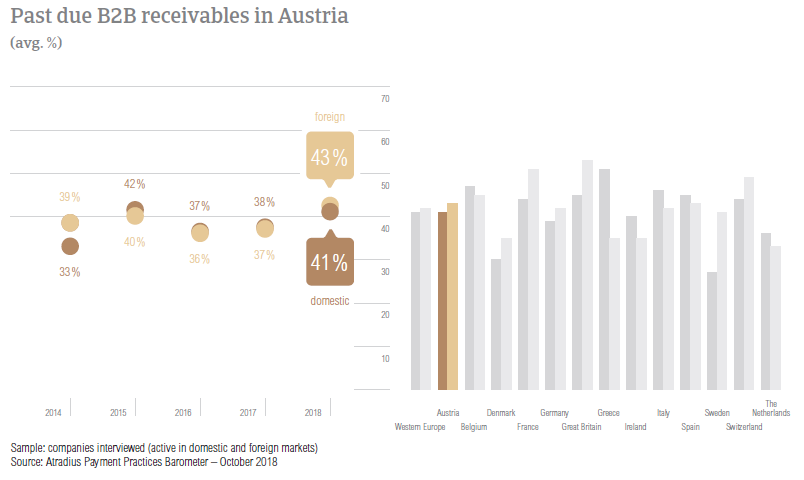

The second consecutive year with an increase in past due receivables

The vast majority of respondents in Austria (95.0%) reported frequent late payments by their domestic and foreign B2B customers. This was the highest percentage in Western Europe and a higher percentage than in 2017, when it stood at 91.5%. Moreover, all survey respondents (100%) reported domestic payment delays.

The proportion of domestic and foreign overdue B2B receivables in Austria increased for the second consecutive year and stands at 42.0%. The average proportion of foreign past due B2B invoices was slightly higher than that of domestic past due B2B invoices.

The Days Sales Outstanding (DSO) figure in Austria is 32 days on average and 2018 marks the third consecutive year of decrease (2017:34 days). 67.3% of respondents said that they do not expect changes in their company’s DSO over the next 12 months. 18.8% foresee an increase and 13.9% a decrease.

Additional financing needed to manage the impact of payment delays

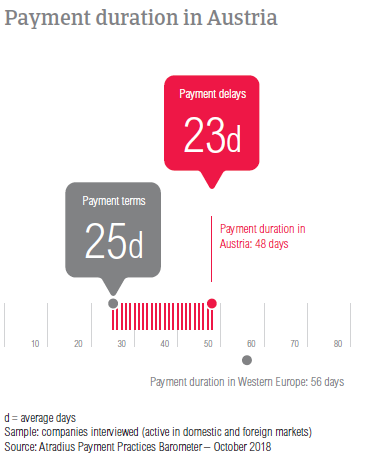

Domestic B2B customers of respondents in Austria are given, on average, 23 days to settle their invoices. This is two days shorter than in 2017. In contrast, foreign B2B customers are given, on average, 27 days to fulfil their payment obligations – two days longer than in 2017. The average payment terms recorded in Austria are in line with the averages recorded in Western Europe overall.

52.8% of respondents in Austria said that they are most likely to differentiate payment terms between domestic and foreign B2B customers. 33.3% said that they would give their domestic B2B customers less time to settle payments, while 19.5% said that they would extend longer payments to domestic B2B customers. The main reasons for differentiating payment terms in Austria are industry practices, the economic situation in the export country and the financial risk related to the export transaction.

B2B customers of respondents in Austria have delayed payments for a longer time in 2018. An increase of two days was reported in respect to domestic B2B customers (on average, 22 days) and an increase of three days in regards to foreign B2B customers (on average, 23 days).

In Austria, payment delays by B2B customers occurred mainly because of insufficient availability of funds and because of buyers using outstanding invoices as a form of financing. 53.4% of respondents in the country stated insufficient availability of funds in regards to their domestic B2B customers and 49.1% in regards to their foreign B2B customers. Both these percentages are higher than those registered in Western Europe overall. The second most frequently cited reason for payment delays in 2018 – buyers using outstanding invoices as a form of financing was cited by 38.2% of Austrian respondents in regards to their domestic B2B customers and by 37.0% in regards to their foreign B2B customers. Once more, these are higher than those registered at regional level.

Among the Western European countries surveyed, Austria had one of the lowest percentages of respondents (38.3%), who reported that payment delays did not affect their businesses significantly. To manage the impact of overdue invoices, 22.8% of respondents in Austria mentioned the need to pursue additional financing and 20.0% said that they needed to take specific measures to correct cash flow and postpone their own payments to suppliers.

The majority of Austrian respondents are invoicing online

67.9% of respondents in Austria said that they are invoicing their domestic and foreign B2B customers electronically. While this shows that the majority are invoicing online, Austria’s percentage is in line with the regional average. Of the Austrian respondents who have not migrated to online invoicing, 10.7% stated their intention to do so in 2018. 18.6% of respondents said that they are not using this method of payment and a low 2.8% that they are no longer invoicing electronically.

Asked about the effect of electronic invoices on payment duration, the majority of respondents (54.8%) said that they received payments faster. In contrast, only 4.1% stated they have experienced slower payments and 41.1% of respondents believe that e-invoicing has no noteworthy effect.

Austrian respondents fear deterioration in global growth due to US protectionism

Like their peers in Western Europe, respondents in Austria perceive US protectionism turning into a trade war as the most significant potential risk to global development (more significant than misguided Fed policy, China’s ‘hard landing’ and geopolitical risk). The 40.4% of respondents in Austria citing this as the main threat to global growth is slightly lower than the regional average of 44.8%. Additionally, 27.5% rated US protectionism as a significant risk – although they don’t believe it will hamper global growth the most.

22.0% of Austrian businesses considered Fed policy to be the second most significant risk to global growth.

A minor increase in uncollectable B2B receivables

In 2018, the proportion of uncollectable B2B receivables stands at 0.9%. This marks a minor increase from 0.7% last year. Despite this, Austria’s proportion of uncollectable B2B receivables is under the regional average of 1.3%.

In Austria, uncollectable receivables originated most often from B2B customers in construction, consumer durables, services and business services. Top reasons for writing off B2B receivables as uncollectable were the customer going bankrupt or out of business (mentioned by 64.8% of respondents), the inability to locate the customer (mentioned by 27.6%) and failure of collection attempts (26.9%).

Construction and consumer durables – problematic sectors

Suppliers in Austria gave their B2B customers in the paper and construction materials sectors payment terms longer than the 25 day average. B2B customers in the paper sector had, on average, 85 days to fulfil payment obligations while those in construction materials received 46 days, on average. In contrast, B2B customers in the agriculture and chemicals sectors had some of the shortest average payment terms (on average, 17 days).

Austrian suppliers reported that B2B customers in the construction and consumer durables sectors generated some of the longest payment delays, on average 24 and 23 days late respectively.

The most frequently reported reasons for payment delays in the construction sector are buyers using outstanding invoices as a form of financing (55.0%) and insufficient availability of funds (48.0%). Austrian suppliers reported that payment delays from B2B customers in the consumer durables sector occurred mainly because of the same reasons. 33.0% of respondents stated buyers using outstanding invoices as a form of financing and 30.0% insufficient availability of funds. Additionally, 30.0% of Austrian respondents in the consumer durables sector stated delays because of the formal insolvency of the buyer.

Austrian respondents stated that they foresee changes in their B2B customers’ payment behaviour over the coming 12 months. 34.0% of respondents in the construction sector expect deterioration and a lower 11.0% improvement. In the consumer durables sector, 24.0% foresee deterioration and 18.0% improvement.