Sharp output growth in 2021 due to vaccine production

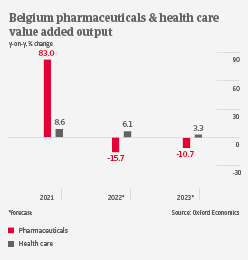

Belgium is one of Europe´s largest producers and a major export hub of pharmaceuticals. In 2019 (i.e. prior to the Covid-19 pandemic spread), the small country accounted for 13% of the EU´s pharmaceutical exports and 10% of pharmaceutical R&D investment. Belgium has become a major producer of Covid-19 vaccines, which led to a whopping 83% pharmaceuticals value added output increase in 2021, while pharmaceuticals exports accounted for 15% of total Belgian exports.

The health crisis has highlighted the strength of Belgian pharmaceutical companies, which were able to accelerate their R&D in record time and to provide several therapeutic solutions. Additionally, the sector has benefited from pent-up demand for non-Covid-19 related medical treatments and healthcare spending since last year.

For Belgian pharmaceutical producers, competition is strong with their European peer businesses, and Belgian companies will have to continue with high spending in R&D in order to stay ahead, i.e. by launching new patented drugs. In the domestic market, pharmaceutical wholesalers and distributors face increasing pressure on margins, as competition is getting fiercer. Distributors from abroad (e.g. France) have entered the Belgian market, and there has been a sharp rise in e-commerce sales by so-called “para-pharmacies”. Those mainly sell over-the-counter drugs and health care products with no need for medical prescription.

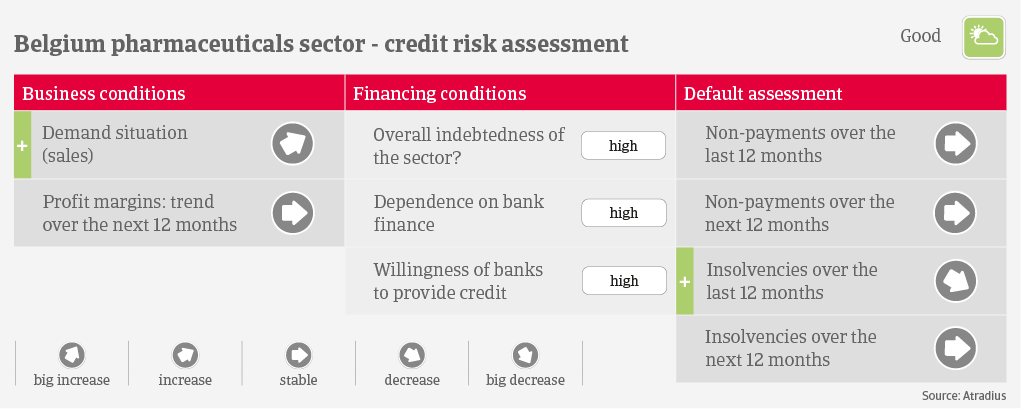

Demand for external financing in the sector is high, in particular from those producers with high R&D expenses. Most pharmaceutical businesses have good access to bank financing, even if they are highly geared. Payment duration in the industry is 30 days on average, and payment behaviour has been good over the past two years. The amount of both payment delays and insolvencies has been low over the past 12 months, and we expect no deterioration of the good credit risk situation in 2022. Therefore, and due to the robust demand situation our underwriting stance remains open for pharmaceutical businesses across all segments.

相關資料

969.0KB PDF