Higher input costs and supply chain issues hit profit margins

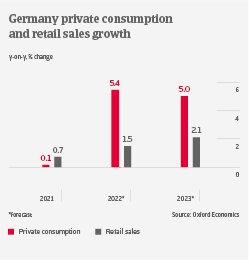

In 2020 and 2021, consumer durables sales benefited from pandemic-related shortfalls of other spending opportunities (e.g. for travel and restaurants). However, 2022 will be a more difficult year. With the lifting of lockdowns there is pent-up demand for services at the expense of discretionary spending. High inflation, triggered by a sharp increase in food and energy prices, has a negative effect on households’ purchasing power. We expect domestic appliances value added to contract by about 3.5%, while furniture should grow a modest 1.5%. However, online non-food retail sales are expected to grow again at double-digit rates (forecast 13.5% this year).

Increased input costs for commodities, transport and energy are major concerns for consumer durables producers and retailers alike. Supply chain bottlenecks remain an issue across all main segments. Shortages could aggravate further if the current lockdowns in major cities and provinces in China persist.

Consumer durables manufacturers and wholesalers strive to pass on increased production and energy costs to retailers. Those operate in a fierce competitive environment, facing subdued discretionary consumer spending and economic uncertainty caused by the war in Ukraine. Therefore, passing on higher prices to end-consumers is very difficult, and we expect gross margins of retailers to shrink during the coming months, mainly affecting brick-and-mortar businesses.

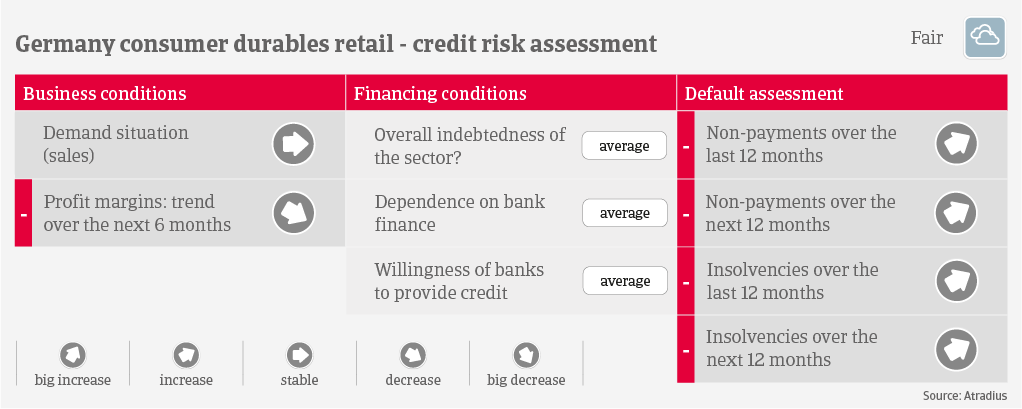

Payments usually take 30-60 days on average, but could also take up to 120 days, particularly when larger retail chains use their leverage vis-à-vis suppliers. We have already observed increasing payment delays and insolvencies during the last twelve months among brick-and-mortar retailers. Due to shrinking margins and lower sales, we expect that insolvencies in this segment should increase by about 10% in the coming twelve months, mainly affecting smaller retailers.

Across all main subsectors, our underwriting stance is generally neutral. With a steadily increasing share of e-commerce and the current issues affecting the industry, we try to obtain interim accounts, in order to continuously check if buyers can maintain sufficient margins.